- 24/7 trading

- No monthly fees

- Institutional level storage

- Regulated custodian

- Limited to U.S. investors

- Crypto is a volatile asset

You can open a cryptocurrency IRA without any setup fees and over 75 supported tokens from one of the oldest providers.

Compare your investment options, fees, and customer experience with my iTrustCapital review.

The Verdict for iTrustCapital

I’ve given them a rating of 9.2 out of 10.

| Criteria | Rating (out of 10) |

|---|---|

| Cryptocurrencies Supported | 9.5 |

| Pricing & Fees | 9.5 |

| Storage & Security | 9 |

| Account Setup & Maintenance | 9 |

| Resources & Tools | 9 |

| Reputation & Reviews | 9.5 |

| Customer Service & Support | 9 |

| Overall Rating | 9.2 |

In this review of iTrustCapital, I’ve followed BIC’s detailed criteria for evaluating the crypto IRA platform.

About iTrustCapital

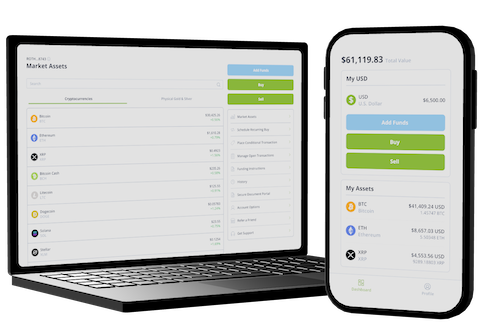

iTrustCapital lets you buy and sell over 75 cryptocurrencies plus gold and silver through tax-advantaged traditional and Roth IRAs.

This online platform has a budget-friendly $1,000 investment minimum, there’s 24/7 access, and no monthly fees.

Over 200,000 crypto IRA investors across the United States have conducted over $13 billion in transactions since its founding in 2018.

It is one of the oldest and largest cryptocurrency IRA companies, with many positive customer ratings and secure storage.

However, the platform doesn’t hold Better Business Bureau (BBB) accreditation like some of its competitors.

In my opinion, this is a minor drawback thanks to the many optimistic iTrustCapital reviews, its massive customer base, and competitive fees.

I like that iTrustCapital lets you invest in crypto and precious metals on the same platform, as most exchanges only focus on one asset class or the other.

You buy and sell these alternative assets using a self-directed IRA (SDIRA).

In-kind transfers are another unique trait that is beneficial if you’re transferring an existing crypto IRA.

This perk means you won’t have to sell your existing positions and repurchase at a potentially higher entry price.

The company is also a sponsor of University of Southern California (USC) Athletics and Everfree. The latter is a non-profit combating human trafficking.

Cryptocurrencies Supported

You can buy or sell over 75 crypto assets with a 24/7 access on the software platform.

Additionally, the platform supports limit and stop loss orders to trade tokens once they reach a specific price.

Some of the most recognized cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Solana (SOL)

- Ripple (XRP)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Avalanche (AVAX)

- Chainlink (LINK)

- Stellar (XLM)

- Aave (AAVE)

- Axie Finity (AXIE)

Many lesser-known altcoins may be of interest to you. I find that iTrustCapital has one of the broadest investment offerings, thus making short-term and long-term trading possible.

Plus, you have the tax advantages of an IRA that taxable crypto accounts lack. Specifically, a crypto Roth IRA makes it possible to enjoy tax-free withdrawals.

Gold & Silver

You can also buy physical gold and silver shares 24 hours a day, seven days a week.

iTrustCapital uses VaultChain to process the blockchain orders through Kitco. Your metals store at the Royal Canadian Mint.

I like that you can purchase these metals by the ounce, which is simpler than other gold IRA companies requiring a specific coin or bar.

When it’s time to make a portfolio distribution, you can sell your digital shares for cash or coordinate physical delivery through Kitco’s platform.

Prices & Fees

First off, the minimum initial investment is $1,000 and subsequent transactions have a $500 minimum.

Both thresholds are budget-friendly and lower than other crypto IRA platforms.

The additional platform and transaction fees are affordable:

| Setup Fee | $0 |

| Crypto Trading Fee | 1.00% per transaction |

| Conversion Fee | $75 |

| Physical Gold | $50 over spot price |

| Physical Silver | $2.50 over spot price |

I like that you won’t pay monthly account fees or deposit fees as some crypto retirement account providers charge.

The 1% transaction fee and the premiums for precious metals are competitive if iTrustCapital has the investment options and platform features you trust.

You can be eligible for a $100 reward when funding your account.

#1 Crypto IRA platform offering cryptocurrencies, gold and silver within your retirement accounts.

Storage & Security

A third-party IRA custodian and an off-site storage facility must track and store your iTrustCapital crypto and metals positions to remain IRS tax-compliant.

All of your assets are held off the balance sheet on a 1:1 basis to avoid unauthorized transactions or commingling them with the custodian’s portfolio.

Fortis Bank is iTrustCapital’s preferred IRA custodian to keep accurate records of your holding and produce tax-reporting documents.

This custodian protects your crypto assets as follows:

- Offline cold storage

- Multi-party computation (MPC)

- Commercial crime insurance policy

- Won’t lend against your assets

- Regular security and financial audits by external firms

You won’t necessarily have access to your crypto keys. Rather, they are on hold as the custodian must verify distributions and transfers.

Since this is a retirement account, you can designate a beneficiary which is helpful if you don’t share your seed phrase with others.

Royal Canadian Mint stores your IRA-eligible precious metals in Ottawa, Canada. It’s non-segregated storage, but your holdings are off the balance sheet and cannot be lent or used as collateral.

This is the most affordable gold IRA storage solution.

Further, the crypto and gold IRA company also partners with Fireblocks and Coinbase Custody to provide institution-grade cybersecurity. Many other crypto exchanges have similar partnerships.

I wish that iTrustCapital disclosed an insurance coverage limit for your crypto and precious metals portfolio. Currently, the terms and conditions suggest purchasing individual policies.

Account Setup & Maintenance

You can open a crypto IRA within a few minutes and start funding your account:

- Open an account online: Creating an account from the iTrustCapital website and the Android or iOS mobile app takes less than 20 minutes. You can navigate the platform without setup fees before scheduling a deposit.

- Fund your account: You can start trading crypto or precious metals after a $1,000 minimum opening deposit. One option is depositing cash by ACH, wire, or check or transferring an existing retirement plan. Depending on the funding method, funding speeds take from one to four weeks for the funding request to process.

- Start buying and selling: It’s possible to buy cryptocurrency, gold, and silver 24/7 from the web or mobile platforms. Most transactions settle within 30 seconds to one minute. You can also place conditional transactions that only execute when hitting your limit or stop loss.

- Offline storage: Crypto assets go into an offline cold storage wallet for maximum security. You can self-trade anytime and hold cash positions that are not FDIC-insured.

- Transfer-outs or distributions: When the time comes, IRA withdrawals and distributions take between 7 and 14 days to complete after signing the corresponding paperwork.

Resources & Tools

iTrustCapital has an online learning center containing short video walkthroughs for account setup and placing trades.

Plenty of FAQs exist about opening an IRA and using the platform.

Additionally, you will see market commentary articles about cryptocurrency, precious metals, and the financial markets.

You can also view historical price charts, but won’t have access to in-depth charting or technical indicators.

The depth of these resources is comparable to other crypto exchanges, in my opinion. For most questions, you will find the answer you need without calling or email customer support.

Reputation & Reviews

On most consumer rating platforms, numerous iTrustCapital reviews are highly positive. Many reviews mention the hands-on help throughout the funding process.

While complaints are relatively few, platform fees and slow withdrawal speeds are the most common.

In fairness, other crypto IRA companies draw similar ire from their users, and it’s worth noting that iTrustCapital remains one of the most affordable.

For instance, it has excellent ratings at the following places:

| Rating Website | Review Score |

|---|---|

| Trustpilot | 4.9 out of 5 with 3.9k reviews |

| Birdeye | 4.9 out of 5 with 3.5k reviews |

| Apple App Store | 4.2 out of 5 with 35 reviews |

| Google Reviews | 4.9 out of 5 with 1,495 reviews |

| Better Business Bureau | 2.33 out of 5 with 3 reviews |

The Better Business Bureau (BBB) is the lone platform where this provider has negative ratings and isn’t BBB-accredited.

The common frustration is slow customer service responses when resolving trading request glitches and processing distribution requests.

Customer Service & Support

Phone support is available on weekdays from 7 a.m. to 12 p.m. and 1 p.m. to 5 p.m. Pacific.

You can also schedule a one-to-one call at your convenience. Email support is available for non-urgent matters.

The advisors work commission-free, preventing high-pressure sales tactics and potential conflicts of interest.

The support team works commission-free, preventing high-pressure sales tactics and potential conflicts of interest.

As usual, you won’t receive individual advice, and I enjoy the no-steering policy that helps you choose the most budget-friendly products for your investing goals.

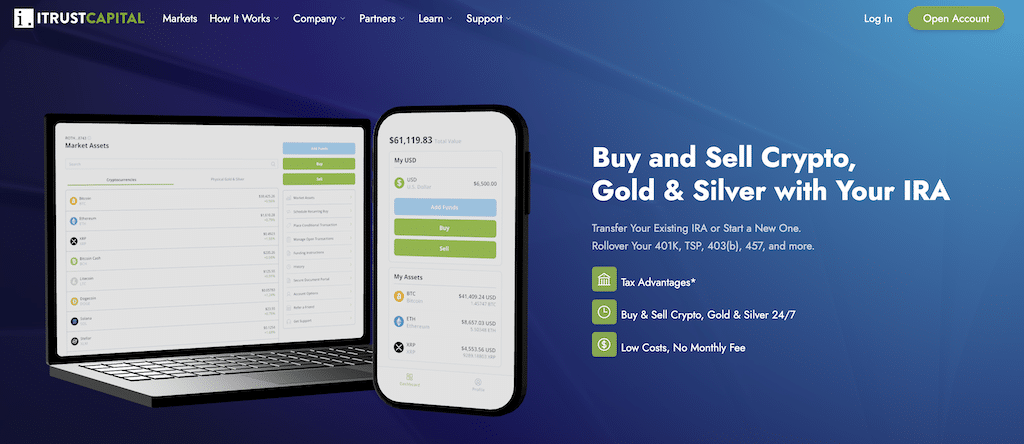

iTrustCapital Alternatives

Below are several other crypto IRA providers with different pricing, custodian, and investment options.

|

Our Rating:

4.8

|

Our Rating:

4.5

|

Our Rating:

4.2

|

|

Trading Fee:

2.00% transaction fee

|

Trading Fee:

$300

|

Trading Fee:

.75%-1.7% transaction fee

|

Bitcoin IRA

Bitcoin IRA supports over 60 cryptocurrencies and a $3,000 minimum investment. Enjoy 24/7 trading and up to $250 million in custody insurance.

However, you will encounter setup fees and annual maintenance fees that are a percentage of your portfolio size.

Open a Bitcoin IRA account in just 3 minutes!

BitIRA

Choose from over 25 cryptocurrencies at BitIRA. The minimum investment is $5,000 and annual fees are from $300 to $1,000.

In addition to insured crypto accounts, your non-invested cash balances qualify for up to $4 million in insurance through its custodian, Equity Trust Company (ETC).

Get a free Ledger Nano from BitIRA

My Digital Money

My Digital Money offers at least 15 cryptocurrencies, gold, silver, and platinum. The minimum investment is $1,000, and you can open a “Play Money” account to simulate trades and learn the platform first.

Further, there are cash and retirement accounts with a $50 setup fee plus percentage-based transaction and custodian fees.

Open a free My Digital Money trading account

Is iTrustCapital Trustworthy?

Yes, iTrustCapital is a legit crypto IRA provider with many liquid cryptocurrency options, affordable fees, and hands-on advisor support.

Buying and selling physical gold and silver on the same platform is also convenient if you don’t want to open a standalone gold IRA.

Trading physical gold and silver on the same platform is also convenient if you don’t want to open a standalone gold IRA.

Open an iTrustCapital crypto IRA and receive a $100 reward with a qualifying deposit.

FAQs

Is iTrustCapital safe?

iTrustCapital uses industry-leading security measures, including cold storage wallets and offers complimentary commercial crime insurance coverage.

Your IRA custodian maintains your keys and has a thorough vetting process to prevent unauthorized withdrawals.

Is iTrustCapital FDIC insured?

Cross River Bank provides up to $250,000 in FDIC insurance coverage for your cash deposits.

Crypto and precious metals holdings are eligible for separate insurance programs through third-party custodians.

Who owns iTrustCapital?

CEO Kevin Maloney is the co-founder of iTrustCapital and works with several investment firms.

#1 Crypto IRA platform offering cryptocurrencies, gold and silver within your retirement accounts.

iTrustCapital

iTrustCapital is the #1 Crypto IRA platform offering cryptocurrencies, gold and silver within your retirement accounts.

Product Brand: iTrustCapital

4.61